Robert Pozen

- Login

Robert Pozen

- Login

Proven Executive

Best-Selling Author

Corporate Speaker

Executive Coach

Personal Productivity, Financial Innovation,

Corporate Governance, and Retirement ChallengesAI for Extreme Productivity

Join for free with your purchase

of Extreme Productivity

Unlock the full potential of your productivity journey with exclusive access to a curated list of AI tools designed to enhance every aspect of your professional life. As a member, you'll gain valuable insights and strategies from Bob Pozen and his team, empowering you to achieve your goals and maximize your productivity.

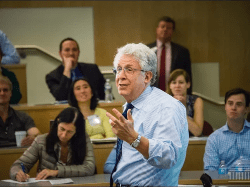

Corporate Keynote Speaker

Speaker

Robert "Bob" Pozen brings his insights and direction to businesses, teams, professionals, conferences and classes. Bob speaks on personal productivity, corporate governance, retirement challenges and financial innovation. He uses his real-world expertise to make his talks engaging and tailored to your organization.

Author & Coach

Author of best selling books and multiple articles on how to become more productive including AI tools.

Bob can help you, your employees and your business become more profitable and successful by better defining your priorities, overcoming constraints and focusing on results.

He customizes his coaching to be responsive to your goals and needs.

Thought Leader

Author of best selling books and multiple articles on how to become more productive including AI tools.

Bob can help you, your employees and your business become more profitable and successful by better defining your priorities, overcoming constraints and focusing on results.

He customizes his coaching to be responsive to your goals and needs.

More about Bob

- National bestselling author including Extreme Productivity: Boost Your Results, Reduce Your Hours

- Senior Lecturer at the MIT Sloan School of Management, and a non-resident Senior Fellow at the Brookings Institution

- Co-Author of Remote, Inc. How to Thrive at Work… Wherever You Are published by Harper Business

- Former president of Fidelity Investments and executive chairman of MFS Investment Management

- Expert who has made hundreds of appearances to companies, television audiences and leaders around the world

- Writer for the New York Times, the Wall Street Journal, the Financial Times, the Harvard Business Review, and more around the globe

On Bob's Coaching:

Guidance

"Bob’s guidance has been extremely transformative for me. His no-nonsense, no-excuses approach helped me reflect on my long-term objectives, establish a plan for getting there and hold myself accountable for forward progress. Learning from Bob has been an absolute gift. If you are willing to listen, reflect, and get uncomfortable to grow as a leader, I cannot recommend Bob enough."

-Elizabeth DeStephens

Leadership

"Since we've been working together in 2014, Bob's been the consistent person I've reflected all my career decisions with. He's been able to expand my thinking as well as help me recognize moments of growth."

-Shivani Kumar

Strategy

"Bob helped me so much in thinking through my strategy and structuring my division at a large hospital. On a personal level, I also benefited tremendously from his insights and practical suggestions about using my time more efficiently."

-Wolfram Goessliing, MD, PhD

On Bob's Seminars:

Extreme Productivity

"Extreme productivity should be critical to every busy professional aspiring to have a thriving career and balanced life. As a heart surgeon at the crossroads of my career, I found Bob Pozen’s approach invigorating —with multiple practical lessons and suggestions. He dives deeply into the core of our daily activities, providing examples and strategies to maximize our productivity."

-Dr. Jeffrey Shuhaiber

In-Depth Analysis

"I pride myself on my personal organization and ability to execute tasks efficiently, but have benefited immensely from Professor Pozen’s in-depth analysis. His ability to dissect individual daily requirements and apply sustainable habits that optimize both quality and quantity of output is critical for executives of all types, regardless of their current level of efficiency."

-Brendan O'Neill

Global Executive Academy

"Bob Pozen, your insights teaching the Global Executive Academy were amazing. I encourage everyone to take one of your classes.

-Josh Brandt

On Extreme Productivity:

Required reading for professionals—and aspiring professionals—of all levels.

-Shirley Ann Jackson,

President of Rensselaer Polytechnic Institute and

Former Chairman of U.S. Nuclear Regulatory CommissionRead this book if you want to learn how to run efficient and effective meetings—or how to avoid them all together.

-J. Michael Cook,

Director of Comcast and IFF, Chairman and CEO Emeritus of DeloitteReach out to Bob